Applications of financial technology (fintech) is now considerably an integral aspect of our day-to-day lives and can be seen in one form or another almost everywhere. Ranging from small transactions with mobile digital banking to revolutionary creations such as blockchain, fintech is becoming instrumental in shaping the world we live in.

Fintechs are valuable for many reasons, among the most evident of which has been its monetary value which, according to a report by McKinsey & Company,represented a market capitalization of US$550 billion as of July 2023, a double increase versus 2019.

However, another, albeit often overlooked feature, is its ethical significance. Fintech’s accessibility is a powerful tool in an industry historically plagued with discrimination.

Black Banx is one such fintech that embodies this change for the good in the industry, impacting lives far beyond its digital transactions. Founded by visionary German billionaire Michael Gastauer, Black Banx has shattered banking barriers since its 2015 launch.

What started as a quest to rectify the flaws of cross-border banking evolved into a global phenomenon, extending financial services to unbanked and underbanked communities across the globe. Through its revolutionary approach, Black Banx not only exemplifies financial innovation but also champions social empowerment, making an indelible mark on both the fintech industry and society at large.

Revolutionizing Access to Financial Services

At the heart of Black Banx’s mission lies a profound commitment to financial inclusion. With services available in over 180 countries, the company has become a lifeline for millions who previously had limited or no access to banking. By offering accounts in 28 FIAT and 2 cryptocurrencies, alongside a suite of other financial services, Black Banx ensures that geography, income, and paperwork are no longer barriers to financial empowerment.

Instant Global Reach

The instant account opening feature, requiring just a photo ID, dismantles the bureaucratic hurdles that often discourage or exclude potential clients. This ease of access, coupled with the ability to handle multiple currencies, positions Black Banx as a global financial ally.

The introduction of a multi-currency debit card, including plastic, metal, and virtual options, further exemplifies Black Banx’s commitment to providing comprehensive and user-friendly financial solutions. This flexibility caters to a diverse clientele, ensuring that regardless of their location or lifestyle, users have access to their finances in a format that suits them best.

Cryptocurrency as a Bridge

By embracing cryptocurrencies early on, Black Banx not only diversified its service offering but also tapped into a burgeoning market of digital-savvy users looking for alternative banking solutions. This forward-thinking move not only broadened its customer base but also showcased the potential of cryptocurrencies in promoting financial inclusion.

The adoption of cryptocurrencies as a deposit method in 2016 was a game-changer, making Black Banx one of the pioneering banking platforms to recognize the potential of digital currencies in facilitating global transactions. This innovation not only attracted a tech-savvy demographic but also set a precedent for other financial institutions, highlighting the importance of embracing technological advancements to meet customer needs.

Empowering Communities through Fintech

Black Banx’s influence extends far beyond individual financial mobility. By democratizing access to banking services, the company fosters economic growth and social development within communities. In areas where banking services were once a luxury, Black Banx has become a tool for entrepreneurship, allowing small businesses to flourish and communities to thrive economically.

The bank’s emphasis on providing solutions like batch uploads or API for bulk payments underscores its commitment to supporting business operations, streamlining financial processes, and enabling businesses to focus on growth rather than administrative challenges.

Economic Opportunities Unleashed

The ability to send and receive international payments instantly and at lower costs has opened up new economic possibilities for businesses in emerging markets. This capability is particularly crucial for small and medium-sized enterprises (SMEs) that rely on cross-border transactions to fuel their growth.

Furthermore, Black Banx’s strategy of connecting local real-time settlement systems across various countries has revolutionized cross-border payments, reducing transaction times and costs, thereby empowering businesses to operate more efficiently in the global marketplace.

Social Upliftment

Financial inclusion is a catalyst for social upliftment. By providing access to banking services, Black Banx plays a pivotal role in reducing poverty and promoting equality. Financial tools that were once out of reach for many are now facilitating savings, investments, and financial security, contributing to a more equitable world.

The expansion into markets like China and Japan, as well as the focus on regions with significant unbanked populations, such as Africa, underscores Black Banx’s dedication to global financial inclusion. This not only expands the company’s footprint but also aligns with its mission to bridge the financial divide, offering a significant opportunity for economic empowerment to millions.

Innovation at the Forefront

Innovation is the cornerstone of Black Banx’s success. By leveraging cutting-edge technologies like blockchain, AI, and machine learning, the company is not just keeping pace with the fintech industry; it’s setting new standards. This commitment to innovation ensures that Black Banx remains at the forefront of financial services, continuously enhancing the user experience and expanding its offerings to meet the evolving needs of its global clientele.

The company’s approach to harnessing the power of emerging technologies not only enhances operational efficiency but also ensures a secure and scalable platform that can adapt to the ever-changing financial landscape.

Continuous Technological Evolution

Black Banx’s exploration of emerging technologies is testament to its dedication to staying ahead of the curve. This not only enhances operational efficiency and security but also ensures that the company can adapt to the fast-changing financial landscape. The integration of blockchain technology, for instance, has not only bolstered the security of transactions but also introduced a level of transparency and trust that is paramount in the financial sector.

This forward-thinking approach has positioned Black Banx as a leader in the fintech space, constantly exploring new ways to innovate and improve the customer experience.

Setting Industry Benchmarks

The transformation of cross-border payments through the integration of local real-time settlement systems exemplifies how Black Banx is redefining industry norms. This innovation has set a new benchmark for speed, cost, and convenience in international money transfers.

Additionally, Black Banx’s commitment to offering real-time currency exchange and crypto trading services has made it a one-stop-shop for financial services, catering to the diverse needs of its global customer base. This comprehensive approach not only simplifies financial management for users but also challenges other institutions to raise their service standards.

A Global Community of Change

Black Banx’s impact is magnified by its global footprint, which spans continents and cultures. With a customer base now exceeding 39 million, the company has built a diverse and vibrant community bound by the common goal of financial empowerment. This global community not only benefits from Black Banx’s services but also contributes to a broader dialogue on financial inclusion and technological advancement.

The establishment of offices in strategic locations like Singapore, Brazil, India, Russia, the UAE, and South Africa further exemplifies Black Banx’s commitment to being a truly global player, reflecting its understanding of the unique financial needs and challenges of different regions.

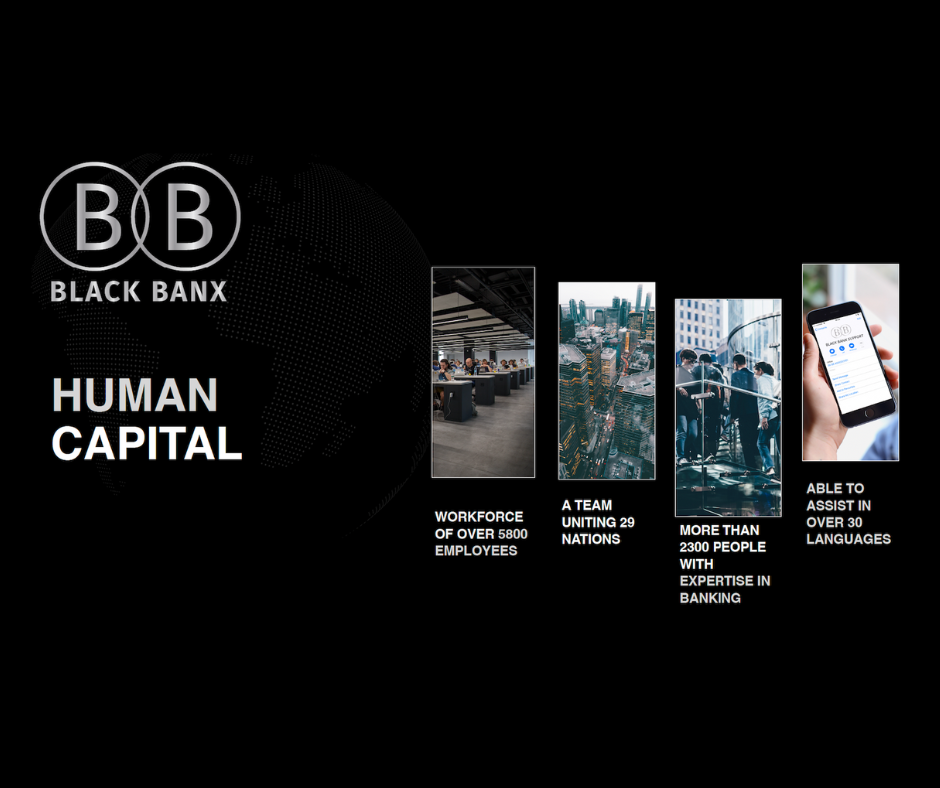

Diverse and Inclusive

Black Banx’s global reach underscores its commitment to diversity and inclusion. By catering to a wide range of financial needs and preferences, the company fosters a culture of inclusivity that transcends borders and backgrounds. This commitment is evident in the company’s flexible product offerings, which are designed to meet the varied needs of its diverse clientele, whether they’re interested in traditional banking, cryptocurrency trading, or seeking innovative payment solutions.

Black Banx’s ability to provide a tailored banking experience to each customer, regardless of their geographical location or financial background, sets it apart as a leader in financial inclusivity.

A Platform for Dialogue

As a leader in the fintech space, Black Banx has become a platform for dialogue on key issues like financial inclusion, technological innovation, and social impact. This conversation is crucial for driving further change and ensuring that the benefits of fintech are widely understood and embraced.

The company’s active participation in industry discussions and its efforts to educate the public about the advantages of fintech further demonstrate its role as a thought leader. Black Banx’s commitment to fostering a dialogue around financial empowerment and technological advancements not only enriches the fintech community but also plays a vital role in shaping the future of global finance.

A Vision for a Financially Inclusive Future

Black Banx’s journey from a visionary project to a global fintech powerhouse illustrates the transformative power of innovation and inclusion. By tearing down the barriers to financial services, the company has not only reshaped the banking industry but has also played a pivotal role in empowering communities and fostering economic growth worldwide.

As Black Banx continues to expand its services and reach, its impact will undoubtedly grow, further cementing its legacy as a catalyst for positive change in both the fintech sector and society at large. In a world where financial empowerment is key to unlocking social and economic potential, Black Banx stands as a testament to the power of technology to bridge divides and create opportunities for all.