Britons are being reminded to check when they will qualify for Department for Work and Pensions (DWP) retirement benefits as the state pension age will begin rising from 66 to 67 from April.

It should be noted that this increase will happen over many months, with the state pension age transition set to conclude in 2028, but when will you be impacted by the looming change?

The state pension age is regularly reviewed and changed by Governments based on a variety of statistics, including life expectancy data. Once someone reaches retirement age, they are entitled to the state pension as well as additional benefits, such as Pension Credit.

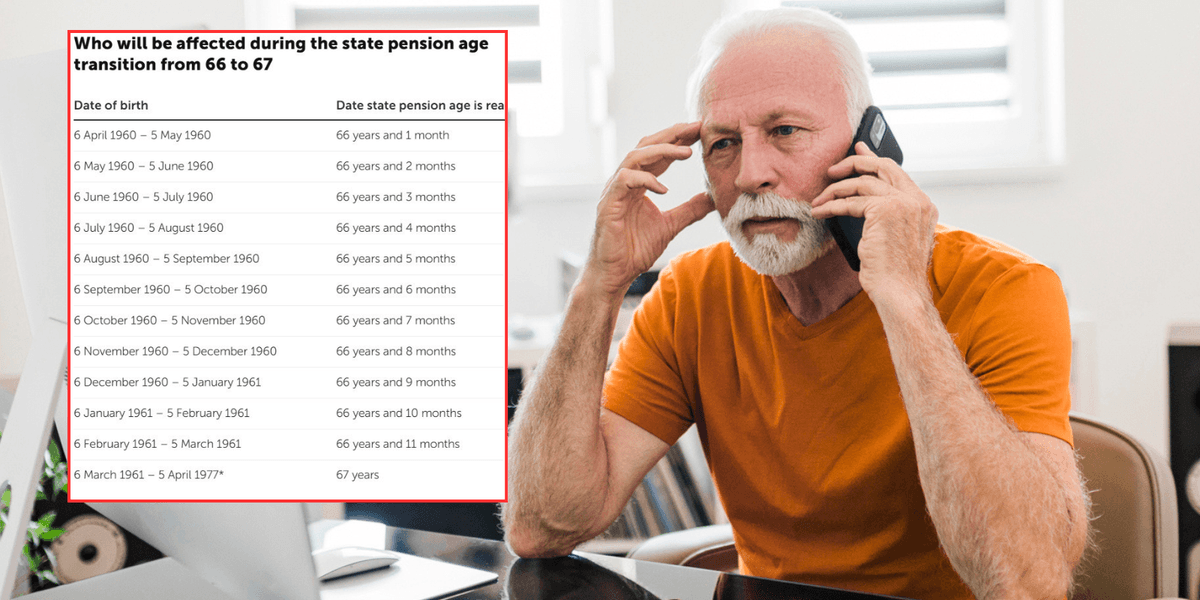

A new chart from investment firm AJ Bell, based on Government information, is breaking down how over 60s will be affected by this year’s change to the state pension age.

A chart from AJ Bell is revealing how you will be impacted by this year’s state pension age increase

|

GETTY / AJ BELL

Hannah Willford, an investment expert at AJ Bell, described the situation as “a recipe for confusion,” noting that “many of those affected during the transition will inevitably be completely unaware that this is happening and have to plug an income gap, albeit potentially only for a few months, as a result.”

Those uncertain about when they will become eligible can access Government online tools to verify both their state pension age and entitlement.

The DWP sends notification letters approximately one month before individuals qualify for the benefit, explaining when and how to submit their claim.

Ms Willford emphasised that while the rise from 66 may catch many off guard, “this is very much the beginning rather than the end of this story.”

When will yoiu be impacted by the state pension increase?

|

AJ BELL / GOV.UK

Current legislation already schedules a further increase to 68, due to take effect between April 2044 and April 2046.

Governments must periodically assess whether the state pension age remains appropriate, meaning ministers could opt to accelerate the timeline, potentially bringing changes forward to the late 2030s.

The annual cost of state pensions is approaching £150billion, with the triple lock mechanism threatening to push this figure higher over time.

Under the triple lock, state pension payment rates are raised annually in line with either the rate of consumer price index (CPI) inflation, average wage growth, or 2.5 per cent; whichever is the highest.

Are you affected by state pension age changes? | GETTY

Ms Willford described this as “a painful nettle that will need to be grasped sooner or later,” suggesting that either the current or a future Government may need to bring forward increases and potentially raise the pension age beyond 68.

Labour Government ministers launched its third review of the state pension age in July 2025.

Two reports have been commissioned to inform the process: an independent assessment led by Dr Suzy Morrissey examining relevant factors for the decision, and analysis from the Government Actuary’s Department on updated life expectancy projections.

Once these reports arrive later this year, the formal review can proceed, though a swift decision is far from guaranteed.

What has the impact of the state pension triple lock been on the public’s finances | OBR

Analysis from the Centre for Ageing Better estimates that those employed beyond state pension age pump more than £60 billion into the UK economy annually, equivalent to roughly two per cent of total gross domestic product (GDP).

This contribution represents four times the projected yearly cost of maintaining the triple-lock and exceeds three times the annual police budget.

Workers aged 65 and over also generate approximately £6.8billion in income tax and employer National Insurance contributions each year, surpassing the total UK tax paid by major multinationals including Amazon and Tesco.

The 65-plus demographic now represents one in 25 of the workforce, with employment rates for this group having more than doubled since 2000 to reach 13.2 per cent.