The Bank of England has confirmed the base rate will remain at 3.75 per cent following today’s Monetary Policy Committee (MPC) meeting, in a blow to British borrowers.

Markets had priced in an interest rate hold by the central bank, as the consumer price index (CPI) inflation rate remains above the financial institution’s desired two per cent target.

At today’s meeting, MPC policymakers voted by a majority of five-to-four to maintain the base rate at its current level of 3.75 per cent.

Notably, four members of the committee voted to reduce borrowing costs by 0.25 percentage points, to 3.5 per cent.

The Bank of England has held the base rate at 3.75 per cent

|

GETTY / CHAT GPT

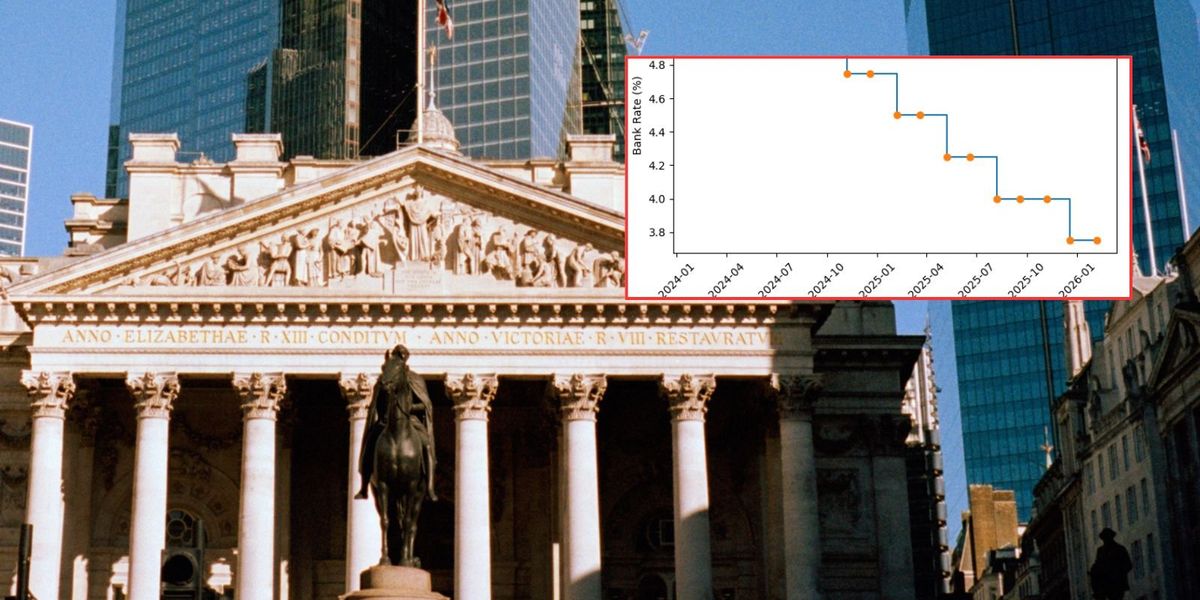

In recent years, policymakers on the central bank’s MPC have voted to raise the cost of borrowing to as high as 5.25 per cent in an effort to rein in inflationary pressures.

However, as the CPI rate has fallen to around three per cent, the Bank of England has brought the base rate down to 3.75 per cent.

This has benefited debt borrowers and mortgage holders, however interest rates remain elevated from pre-pandemic levels.

Charlie Ambler, the co-chief investment officer and partner at wealth management firm Saltus, said: “Having cut the base rate to its lowest level in almost three years in December, the Bank of England now finds itself in a more delicate phase of the easing cycle.

Another interest rate cut is expected this year | GETTY/PA

Bank of England Governor Andrew Bailey

|

Getty Images“Progress on services inflation and wage growth remains key, and with headline inflation ticking higher last month, the consensus expectation is that rates will be held at 3.75 per cent this week.

“Short term fluctuations in inflation data are unlikely to alter the broader direction of travel, but the Bank will be keen to reinforce its commitment to a gradual and measured approach to rate cuts.

“The full disinflationary impact of the tax measures announced in the Autumn Budget has yet to feed through, which means policymakers are likely to strike a cautious tone in their forward guidance.

“How confident the Bank sounds that inflationary pressures are being brought under control will be closely watched by markets.

How has the base rate changed in recent years?

|

CHAT GPT

“For investors, the backdrop remains one of uncertainty. Persistent inflation pressures and ongoing geopolitical risks continue to shape asset allocation decisions, reflected in sustained demand for both gold and Government bonds.

“In this environment, the focus should remain firmly on quality and resilience, with disciplined portfolio construction and selective exposure to interest-rate-sensitive areas and UK equities where valuations remain compelling.”

THIS IS A BREAKING NEWS STORY…MORE TO FOLLOW