Britain’s state pension expenditure is a ticking time bomb that is set to go off, with analysts warning the Government will need to take action to ensure its long-term viability for future generations.

Based on data from the Office for National Statistics (ONS), total spending on the retirement benefit during 2023–24 came to £124billion, part of a broader £141–150billion budget for pensioner benefits, including Pension Credit and Winter Fuel Payments.

Last week, the Adam Smith Institute (ASI) sounded the alarm that the state pension could become insolvent by 2036 despite recent tax rises unless reform is seriously considered.

Despite this call to action, many of the proposals being floated appear unpopular with the British public, yet analysts warn that an overhaul of the status quo is necessary.

Here are the four ways the state pension could change in the near future:

Britain’s state pension is set for reform as the cost of the benefit soars

GETTY / CHAT GPT

Double lock

As it stands, state pension payment rates rise annually by either inflation, average earnings or 2.5 per cent under the triple lock; whichever is the highest figure. The Institute of Fiscal Studies (IFS) has noted a “double lock” mechanism may halve additional expenditure growth, saving £18-37billion in today’s terms by mid‑2060s.

Notably, the think tank claims if ministers opted to raise payment rates by the consumer price index (CPI) rate of inflation only, the Government could save an estimated £10billion a year.

Jon Greer, the head of retirement policy at Quilter, suggested an alternative mechanism to the triple lock, sharing: “A renewed uprating mechanism would help align pension increases with the economic prosperity of the country, ensuring that pensioners’ incomes grow appropriately alongside uplifts received by the working population. In such a mechanism, there may need to be an allowance for circumstances where inflation is relatively high.

“For example, this could mean that if wage growth lags behind inflation, the state pension will increase in line with prices until real earnings recover. Once they have, the state pension could then revert back to its benchmark proportion of average earnings. This would ensure pensioners share in the proceeds of economic growth, while protecting their income against inflation and ensuring intergenerational fairness by making the State Pension more sustainable.”

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

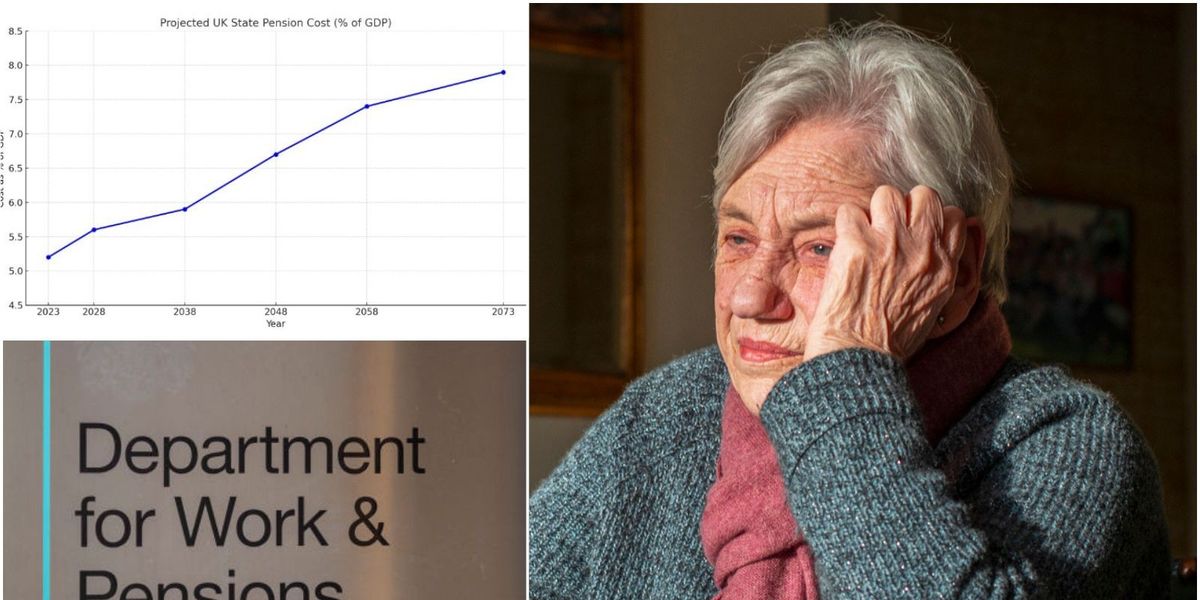

How much will the state pension cost as a percentage of gross domestic product (GDP) ?

ONS / CHAT GPT

Stealth tax raid

Critics have highlighted that the full, new state pension is dangerously close to crossing over the personal allowance threshold of £12,570 within the next couple of years.

As it stands, someone in receipt of the full retirement benefit gets £11,973 annually. With the triple lock in place, Britons cold end up paying tax on their state pension alone for the first time ever, which could see the Government claw back revenue to pay for pensioner benefits.

However, Rebecca Lamb, an external relations manager at Money Wellness, warned: “If the Government continues to freeze the personal allowance while maintaining the triple lock, we will almost certainly see more pensioners needing debt advice.

“The people we support are already walking a financial tightrope. Many live on the basic state pension and a small private pension or savings, just enough to scrape by. If they’re dragged into paying tax on their pension income, it could tip them over the edge.”

Age hike

A recent report from the IFS suggested the Government would need to consider hiking the state pension age to 74 years old sooner rather than later, if the triple lock continues to exist.

In its final Pensions Review, the think tank stated: “Increases in the state pension age required to keep spending on the state pension below a certain level of national income would have to be substantial.”

LATEST DEVELOPMENTS:

Means testing and link to average earnings

Controversially, analysts have called for policymakers to consider a similar eligibility model for the state pension to other payments from the Department for Work and Pensions (DWP), such as Universal Credit.

It is argued means testing state pension could significantly bring down the Government’s welfare spending and keep the retirement benefit available to those who most need it.

Greer added: “As part of this, UK political parties should come together to agree what the level of the State Pension should be relative to mean full time earnings.

“Once this is determined, there should also be an agreement on a change to the uprating mechanism to one based on average earnings which is acceptable to provide a minimum standard of living in retirement. This review could be conducted alongside the next review of the state pension age, required in each parliament or as part of the next stage of the Pension Review.”