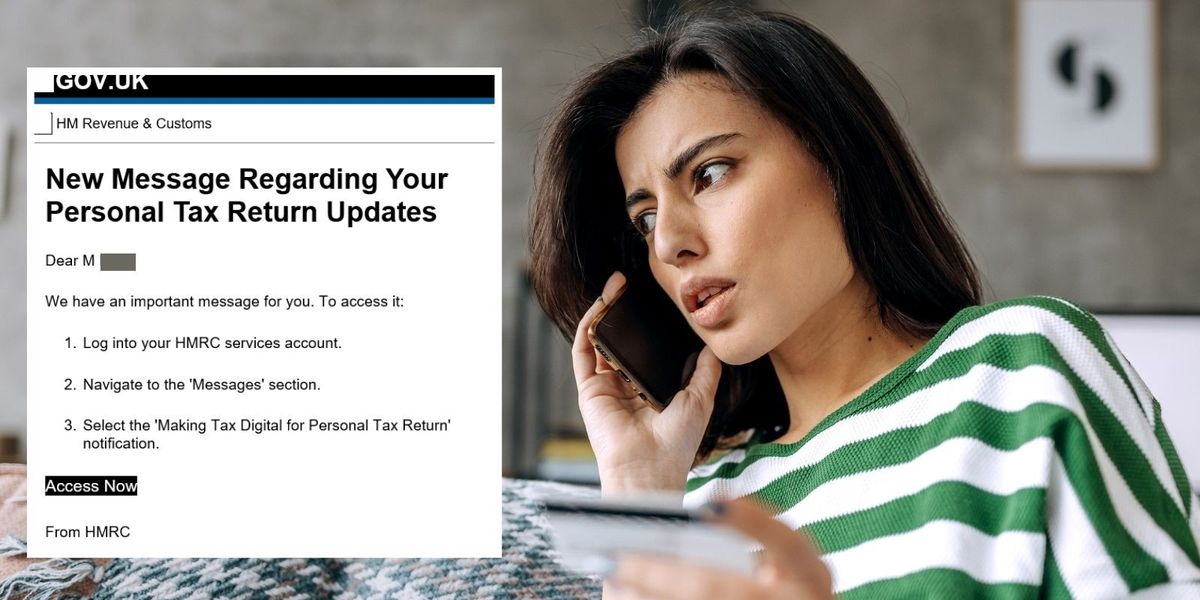

HM Revenue and Customs (HMRC) has issued an urgent warning to taxpayers about scams ahead of the January 2025 self-assessment deadline, following a significant rise in fraudulent activity.

They have reported a 16.7 per cent increase in scam referrals, with 144,298 cases recorded between November 2023 and October 2024.

Fraudsters are actively targeting individuals completing their tax returns with bogus offers of tax refunds and making demands for payments to obtain personal and banking information.

Concerned customers reported nearly 150,000 scam referrals to HMRC in the last year, as Self Assessment filers are warned to be alert to fraudsters.

HMRC revealed that approximately half of all scam reports in the past year involved fraudulent tax rebate claims.

The surge in criminal activity has seen scam referrals rise from 123,596 to 144,298 cases in just 12 months.

These scams typically involve criminals attempting to get a hold of personal information and banking details through deceiving text messages and emails.

HMRC is urging people to beware of fake tax refund emails after thousands of people reported suspicious messages

HMRC | GETTY

HMRC has outlined clear guidelines on when and how they would legitimately reach out to people.

The organisation emphasised that it will never leave voicemails threatening legal action or arrest. Similarly, HMRC confirmed it does not request personal or financial information through text messages.

Taxpayers are advised to consult gov.uk if they receive any messages claiming to be from HMRC that request personal details or offer rebates.

These safeguards are designed to help individuals distinguish between genuine HMRC communications and fraudulent attempts to obtain sensitive information.

Kelly Paterson, chief security officer at HMRC, said: “With millions of people filing their self-assessment return before January’s deadline, we’re warning everyone to be wary of emails promising tax refunds.

“Being vigilant helps you spot potential scams. And reporting anything suspicious helps us stop criminal activity and to protect you and others who could have received similar bogus communication.

“Our advice remains unchanged. Don’t rush into anything, take your time and check HMRC scams advice on gov.uk.”

HMRC has clarified that legitimate tax refunds can be claimed through two official channels: via their online HMRC account or through the free and secure HMRC app.

For those who encounter suspicious communications, HMRC has established multiple reporting channels.

Suspected phishing emails should be forwarded to phishing@hmrc.gov.uk.

Suspicious text messages claiming to be from HMRC can be reported by forwarding them to 60599.

Tax scam phone calls should be reported directly to HMRC through the gov.uk website.

These reporting mechanisms help HMRC track and combat fraudulent activity targeting taxpayers.

Scams advice from HMRC:

Protect

- Criminals are cunning – protect your information

- Take a moment to think before parting with your money or information

- Use strong and different passwords on all your accounts so criminals are less able to target you

Recognise

- If a phone call, text or email is suspicious or unexpected, don’t give out private information or reply, and don’t download attachments or click on links

- Check on GOV.UK that the contact is genuinely from HMRC

- Do not trust caller ID on phones. Numbers can be spoofed